Daily Events

10:15 | Special Event

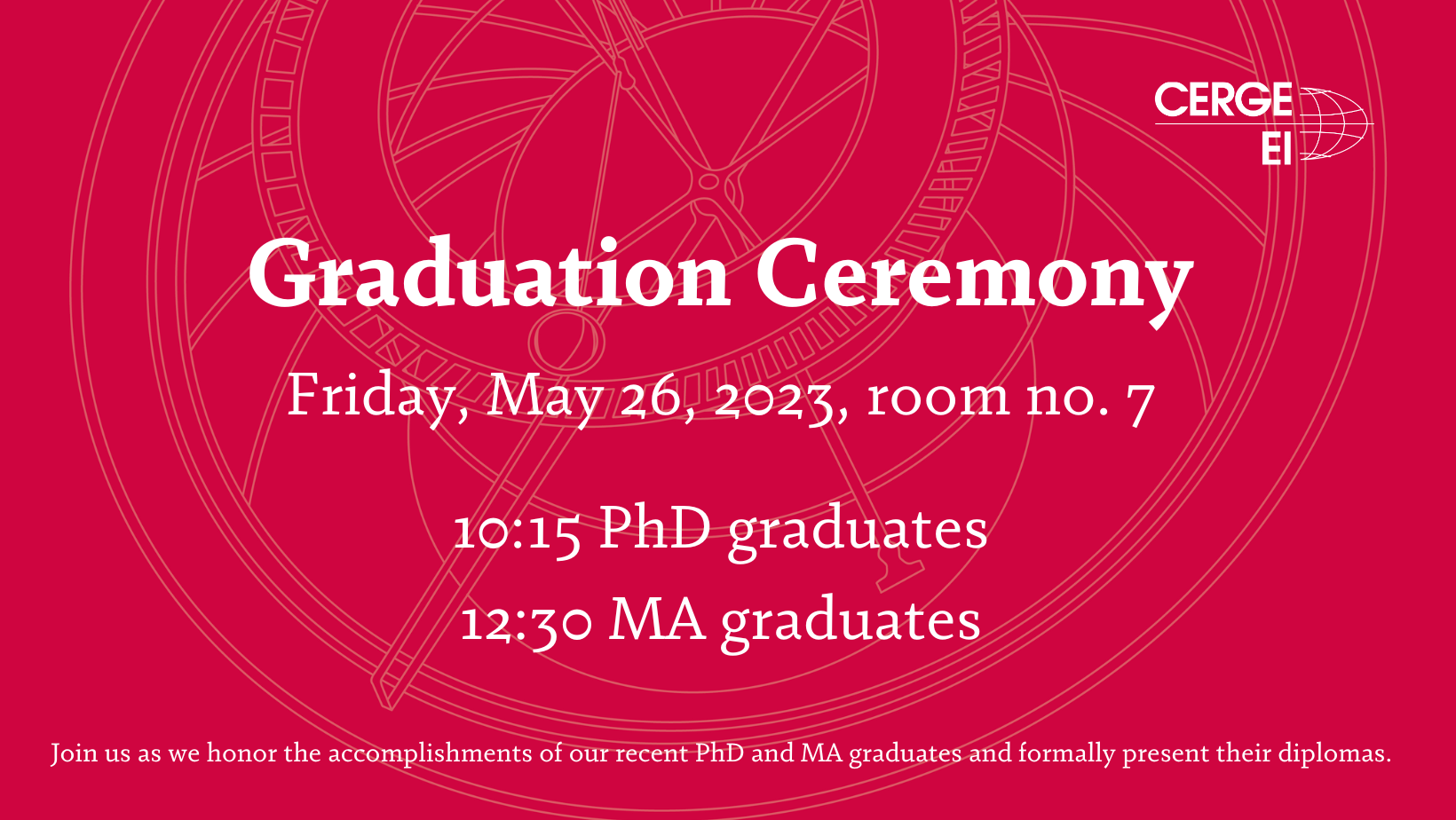

MA and PhD Graduation Ceremony 2023

We are pleased to invite you to the CERGE-EI MA and PhD Graduation Ceremony on Friday, 26 May 2023.

The special guest for this year’s ceremony will be Prof. Larry Samuelson, a CERGE-EI Executive and Supervisory Committee member, and A. Douglas Melamed Professor of Economics at Yale University, United States.

PhD Graduation Ceremony Program

| 10:15 |

Opening by Sergey Slobodyan, Director of CERGE-EI |

|

Address by Jan Švejnar, CERGE-EI ESC chairman, Columbia University |

|

|

Address by PhD in Economics graduate Mykola Babiak |

|

|

Presentation of Diplomas |

MA Graduation Ceremony Program

| 12:30 |

Opening by Sergey Slobodyan, Director of CERGE-EI |

|

Address by Larry Samuelson, CERGE-EI ESC member, and A. Douglas Melamed Professor of Economics at Yale University, United States |

|

|

Address by MA in Economics graduate Sofiana Sinani |

|

|

Presentation of Diplomas |

| 14:00 | Closing, reception to follow |

14:00 | Micro Theory Research Seminar

Philipp Strack (Yale University) "Taxing Externalities Without Hurting the Poor"

Yale University, United States

Join online: https://call.lifesizecloud.com/18158192 (Passcode: 7269)

Authors: Philipp Strack, Mallesh Pai

Abstract: We consider the optimal taxation of a good which exhibits a negative externality, in a setting where agents differ in their value for the good, their disutility from the externality, and their value for money, while the planner observes neither. Pigouvian taxation is the unique Pareto efficient mechanism, yet it is only optimal if the planner puts higher Pareto weights on richer agents. We derive the optimal tax schedule for both a narrow allocative objective and a utilitarian objective for the planner. The optimal tax is generically nonlinear, and Pareto inefficient. The optimal mechanism might take a “non-market” form and cap consumption, or forbid it altogether. We illustrate the tractability of our model by deriving closed form solutions for the lognormal and Rayleigh distribution. Finally, we calibrate our model and derive optimal taxes for the case of air travel.

JEL Classification: D82, H21

Keywords: externalities, redistribution, taxation, mechanism design